September 5, 2025:

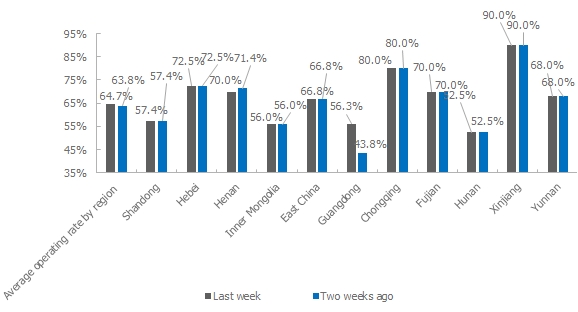

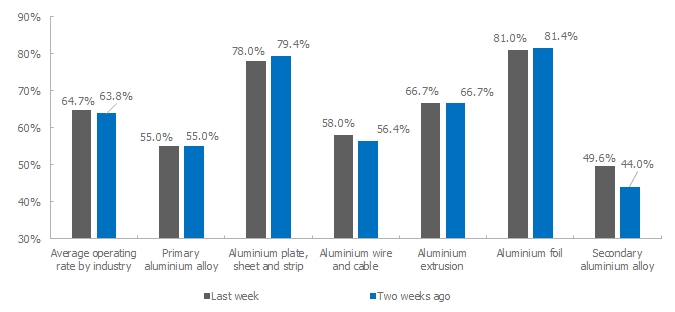

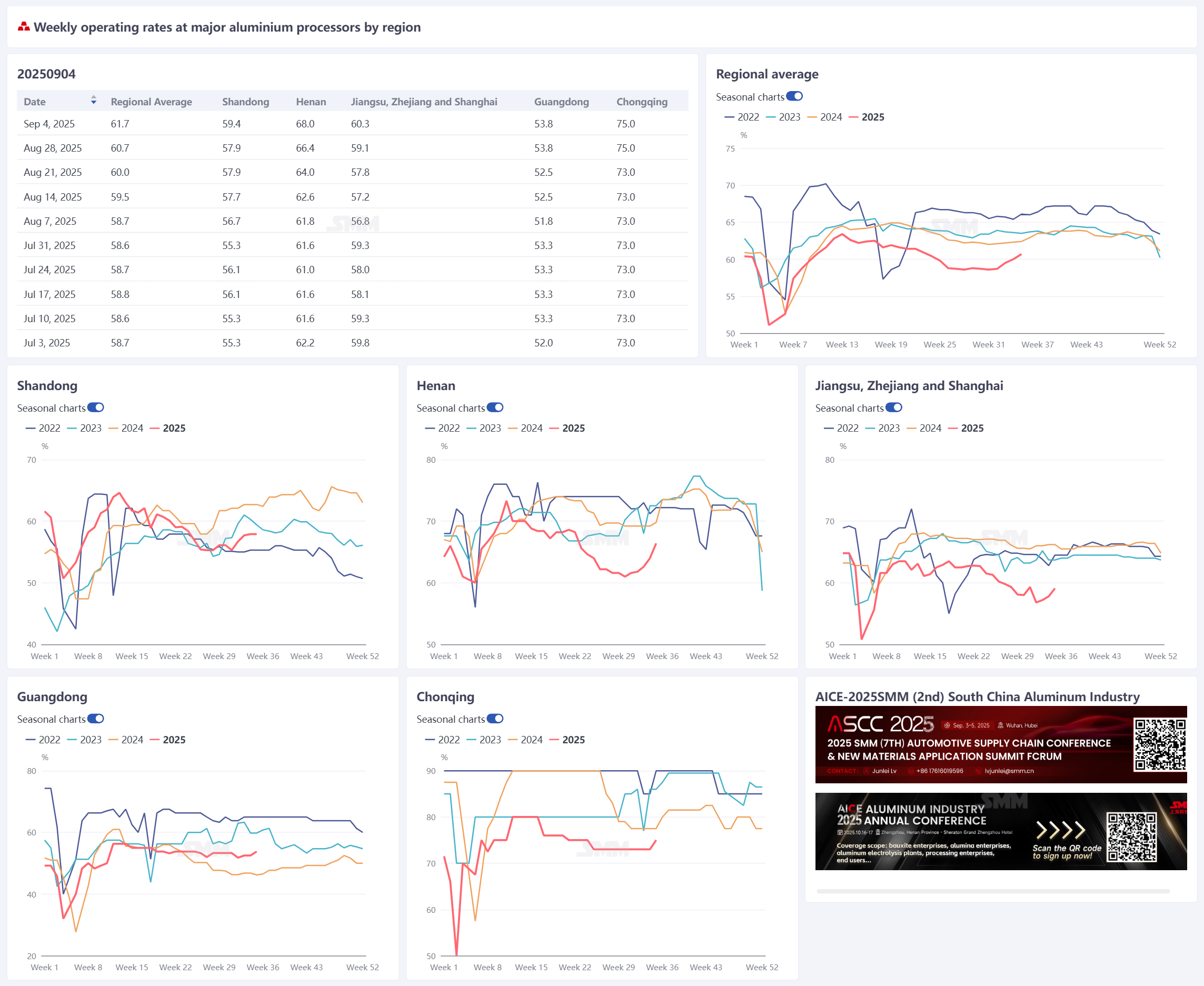

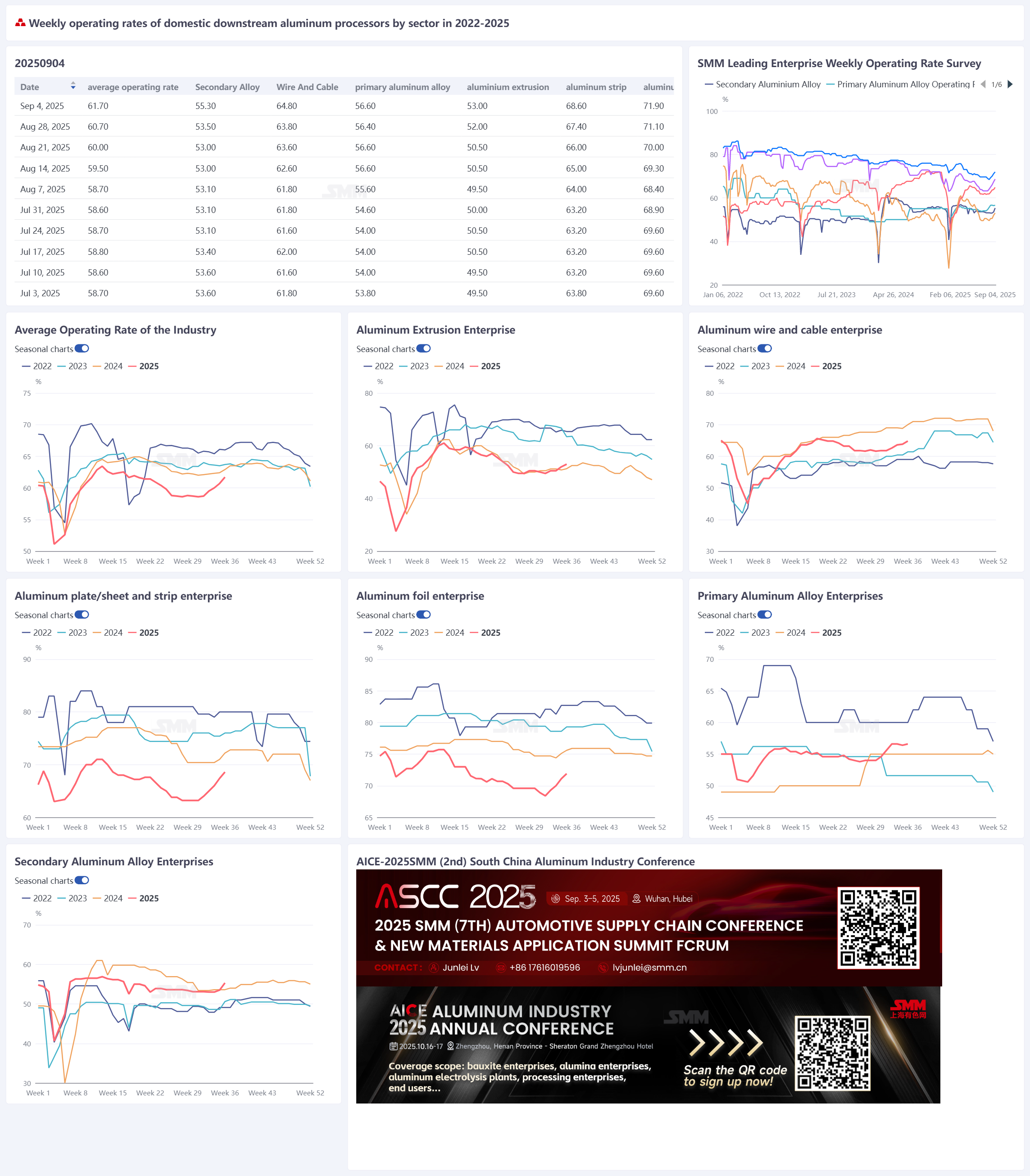

This week, the overall operating rate of leading domestic aluminum downstream processing enterprises rose 1 percentage point (ppt) WoW to 61.7%, as the "September peak season" effect gradually emerged, with recovery trends improving across all sectors. The operating rate of primary aluminum alloy producers edged up 0.2% to 56.6%, showing a slow recovery pace during the peak season, as the time-lag effect of policy support transmitting to end-use demand persists, with no clear positive factors driving a significant rise in operating rates. The operating rate of leading aluminum plate/sheet and strip producers surged 1.2 ppts to 68.6%, benefiting from order volume growth in automotive and 3C sectors and a rebound in foreign trade, while higher aluminum prices boosted stockpiling willingness, making it the industry chain's recovery leader. The operating rate of the aluminum wire and cable industry increased 1 ppt to 64.8%, driven by concentrated delivery of power grid orders in Jiangsu and Henan, though small and medium-sized producers in Hebei lagged due to environmental protection-driven production restrictions during the military parade, with the rate expected to exceed 66% next week after capacity release in North China. The operating rate of aluminum extrusion producers rebounded 1 ppt to 53%, as construction extrusion remained weighed down by real estate but was supported by export orders to the Middle East and Africa, while industrial extrusion saw continued PV module installation rush and initial signs of growth in automotive battery tray orders. The operating rate of leading aluminum foil producers maintained steady growth of 0.8 ppts to 71.9%, with packaging foil and decorative foil replacing air-conditioner foil as new drivers, as the industry prepares for the Mid-Autumn Festival and National Day stockpiling cycle. The operating rate of secondary aluminum producers rose significantly by 1.8 ppts to 55.3%, lifted by the end of environmental restrictions and peak-season restocking, though tight aluminum scrap supply and uncertain tax rebate policies continued to constrain capacity release among small and medium-sized enterprises. SMM analysis indicates the aluminum processing industry has entered a "structural peak season," with broader operating rate increases expected by mid-September, focusing on key variables such as power grid construction cycles, PV export performance, and automotive industry order patterns.

Primary Alloy: In the first week of September, the operating rate of primary aluminum alloy producers edged up 0.2% WoW to 56.6%, showing a slow recovery pace in the early peak season. With the traditional consumption peak season starting in September, the resumption of primary processing sectors like aluminum billet continued, maintaining the diversion effect on liquid aluminum. Some producers optimized product structures and expanded niche orders to sustain capacity release, but overall operating rate growth remained limited. Feedback from producers showed that top-tier enterprises maintained stable primary aluminum usage WoW, with relatively high capacity utilization rates due to order stability and resource integration advantages, while small and medium-sized producers still faced weak orders, with most reporting no significant improvement in downstream purchase willingness. Actual recovery fell short of expectations, with demand-side constraints remaining the core industry challenge. Although tariff risk disturbances eased and some downstream producers began tentative restocking, providing temporary market support, end-use consumption recovery has yet to meet expectations, and the time-lag effect of policy support transmitting to end-use demand persists. SMM maintains its earlier weak-steady recovery outlook, with no clear positive factors driving a significant operating rate increase in the short term, expecting only gradual improvement ahead.

Aluminum Plate/Sheet and Strip: This week, the operating rate of leading aluminum plate/sheet and strip producers rose 1.2 ppts WoW to 68.6%. Aluminum prices hovered at highs, with spot prices fluctuating between 20,600-20,800 yuan/mt. As the "September peak season" began, market sentiment continued to recover, with some producers reporting growth in both domestic and export orders, while raw material and finished goods stockpiling willingness strengthened. Downstream, demand from automotive and 3C sectors remained robust, serving as key drivers for the operating rate increase. Overall, the operating rate is expected to maintain its upward trend in September, with sustained downstream recovery likely to spur new growth.

Aluminum Wire and Cable: The operating rate of the aluminum wire and cable industry rose 1 ppt WoW to 64.8%, as leading producers confirmed the gradual pickup in cargo pick-up activity during the peak season. Regionally, top producers in Jiangsu and Henan led the recovery with concentrated power grid order deliveries, while small and medium-sized producers in Hebei lagged due to environmental restrictions during the military parade. Production schedules showed limited new orders but stable support from existing orders, with some producers still in the capacity ramp-up stage due to power grid orders concentrated for October delivery. Procurement-wise, producers mainly consumed in-factory inventory this week, with weak spot market purchases, though restocking for rigid demand is expected to increase. SMM expects the operating rate to exceed 66% next week, as post-parade production resumes in North China and State Grid orders concentrate in H2.

Aluminum Extrusion: The operating rate of leading domestic aluminum extrusion producers rose 1 ppt WoW to 53%, with industrial extrusion showing early recovery signs. Construction extrusion remained under pressure from declining housing starts and completions (NBS data), though export orders to the Middle East and Africa provided some support. PV extrusion maintained high operating rates among top producers in Anhui and Hebei, driven by Q3 export installation rush, while small and medium-sized producers saw new order increases but remained cautious due to processing fee pressures. Automotive extrusion stabilized, with some producers in Fujian and Anhui reporting increased battery tray orders, while one medium-sized producer in Anhui expects further volume growth in October-November. Other industrial extrusion sectors, such as radiators and 3C components, saw slight order increases, though smaller specifications limited production boosts. Overall, initial signs of order recovery emerged as the peak season began, with SMM monitoring actual order fulfillment progress.

Aluminum Foil: The operating rate of leading aluminum foil producers rose 0.8 ppts WoW to 71.9%, building on last week’s 1.1 ppt increase, further solidifying the recovery trend. Downstream, seasonal demand for air-conditioner foil weakened, while new energy sectors provided stable support via battery foil and brazing foil orders. With the peak season approaching, procurement demand in home decoration and packaging sectors gradually released, boosted by pre-holiday stockpiling, driving order recovery in decorative and packaging foil. Overall, the operating rate is expected to maintain steady growth.

Secondary Aluminum Alloy: The operating rate of leading secondary aluminum producers rose 1.8 ppts WoW to 55.3%, showing mild recovery as the traditional peak season began, though order growth fell short of expectations. The increase was driven by seasonal demand recovery and the end of environmental restrictions in Hebei and Jiangxi. However, ongoing challenges include unclear local tax rebate policies, dampening market sentiment, and persistently tight aluminum scrap supply, particularly tense scrap, keeping procurement costs high. In the short term, the operating rate is expected to maintain a gradual upward trend.

![2026 Arrangements for Secondary Aluminum Alloy Enterprises During Chinese New Year Break [SMM Analysis]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)

![Costs Drag Down Supply-Demand Pressure, Aluminum Auxiliary Material Prices Under Pressure and Weaken [SMM Analysis]](https://imgqn.smm.cn/usercenter/NQyKF20251217171655.jpg)